-

20+Years of Experience in Taxation

-

2500+GST Registration

-

3000+Clients Across all over India

GST Annual Return and GSTR 9 An introduction

GST Annual Return in GSTR 9 is Annual Summary of the Total Sales, Total Purchase, and total Liability, GST is an indirect tax which has replaced much indirect tax in India. it is levied on the supply of goods and services. It is levied at every point of sale. GST Annual Return is an aggregate summary of all GST Returns(GSTR-9).

What is Form GSTR-9?

GST Annual Return is filed in from GSTR-9 which is an annual GST return form, Which is to be filed by the register taxpayers for each financial year. Before such return filed, the taxpayer needs to assure that all returns under GSTR-1 and GSTR-3B have been filed for the year. The annual return form must be filed for each GST registration he has acquired and is also needed to file even if registration is canceled during the year.

Who is required to file, Form GSTR-9?

All register taxable person under GST must file GSTR-9, GST Annual Return, in Short, all persons registered under GST need to File GSTR 9

The articles Cover GST Annual Return, GSTR-9 covers the following are;

1. Who must file GST Annual Return in GSTR-9 2. prerequisites to keep in mind while filling GST Annual Return GSTR-9 3. Procedure for GST Annual Return GSTR-9

Prerequisites to keep in Mind While filing GSTR-9

1. A taxpayer should have filed GSTR-1 and GSTR-3B for the financial year before filing the

annual return.

2. Because it is a compilation data file in GSTR-1 and GSTR-3B and GSTR 2A.

3. A normal taxpayer has registered under GST at least for a single day in a financial

year.

4. please note, that table number 6A will be auto-filled based on the GSTR-3B.

5. Similarly, table number 8A will auto-filled based on GSTR-2A

TYPES OF GST ANNUAL RETURNS

GST Annual Returns GSTR-9 has four different return form

1. GSTR_9 – It has to fill by the regular taxpayer.

2. GSTR-9A- It has to fill by person register under composition scheme.

3. GSTR-9B – It has to fill by the E-commerce operator.

4. GSTR-9C – It has to fill by the taxpayer whose annual turnover is exceeding Rs.2 crore

during the financial year.

5. Online GST Annual Return filing is compulsory for filing.

Procedure to file GSTR-9

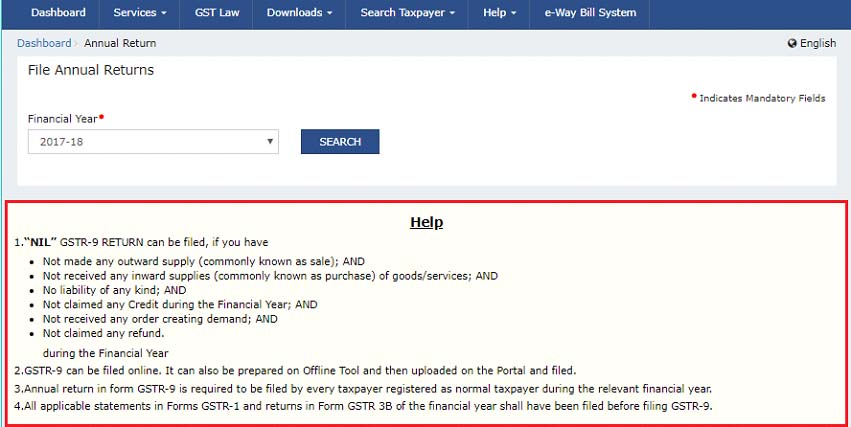

Step-1: access the https://www.gst.gov.in/ in URL.

Step-2: Login to GST portal and go to Return Dashboard and click on Annual Return

Step-3: Select the financial year on the File Annual return page.

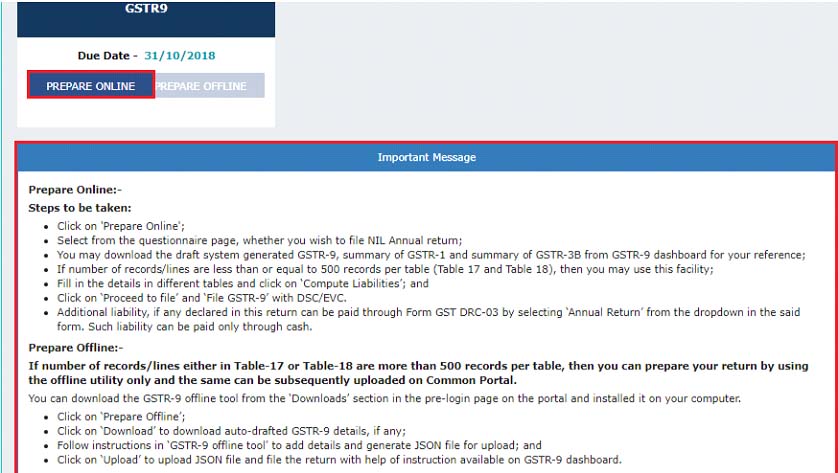

Step-4: A message will pop-up to perform for online/offline in GSTR-9.

Step-5: Click on “prepare online”.

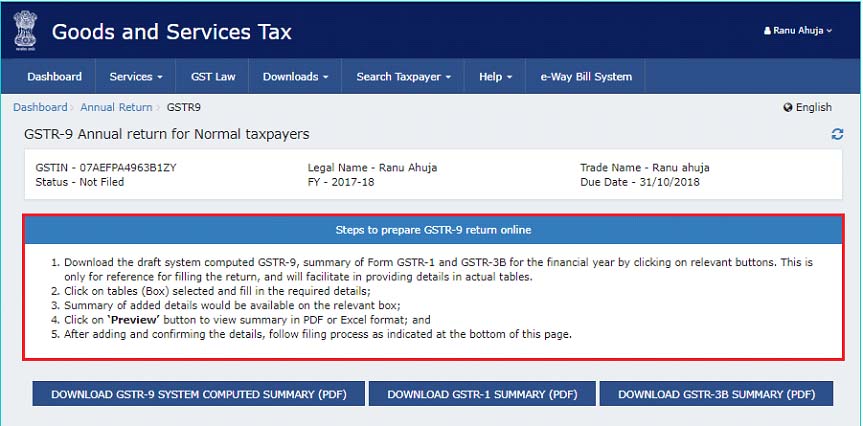

Step-6: After clicking on prepare online it will take you to the annual return for normal taxpayer page.

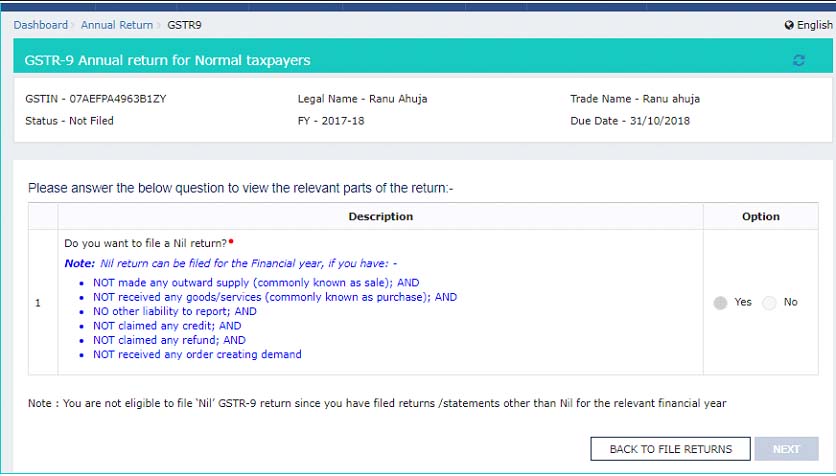

Select YES only if the above criteria has satisfied

1. If you choose “YES” for nil returns, then click on next to compute liability and file

GSTR-1.

2. If you choose “NO” for nil return, then click on next, an annual return for a normal

taxpayer page will display. it will contain the various title in which details must be

filed.

Step-7: Click on all three tabs to download

1. GSTR-9 System computed summary

2. Download GSTR-1 Summary

3. Download GSTR-3B Summary

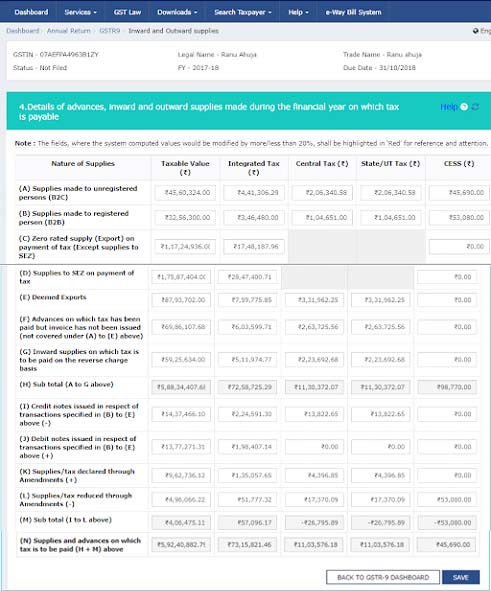

Step-8:After clicking on all three tabs; click on the tile, details will auto-populated on the basis of information provided in GSTR-1 and GSTR-3B

Step-9:click on save, a confirmation message will pop-up asking you if you want to proceed or not.

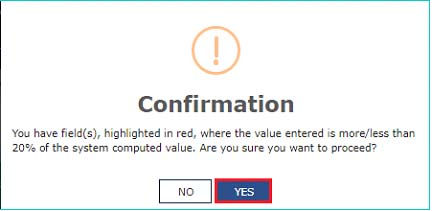

Step-10:Click yes; details are accepted

Step-11:Confirmation message displays in screen

Step-12:Now go to return dashboard

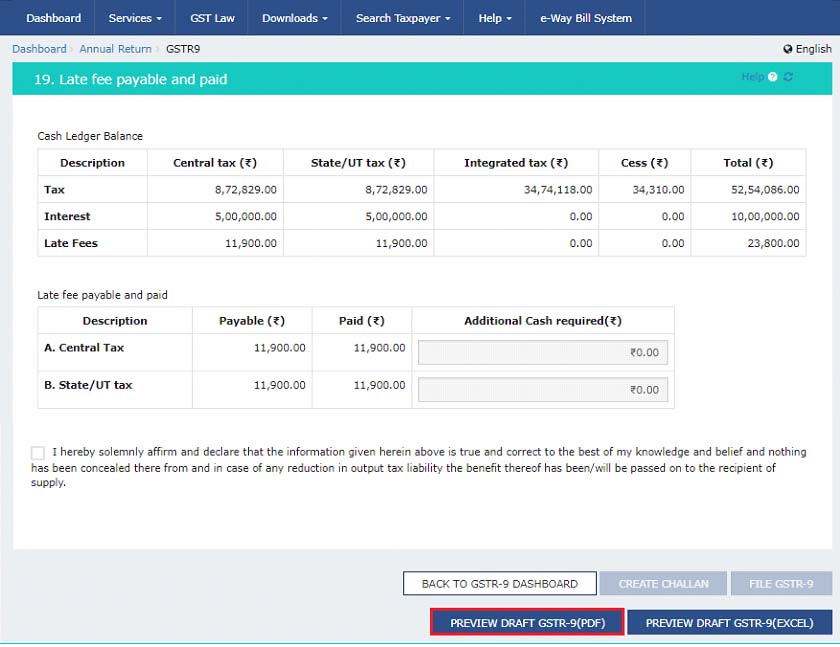

Step-13:Click preview on GSTR-9, it will preview the details of GSTR-9

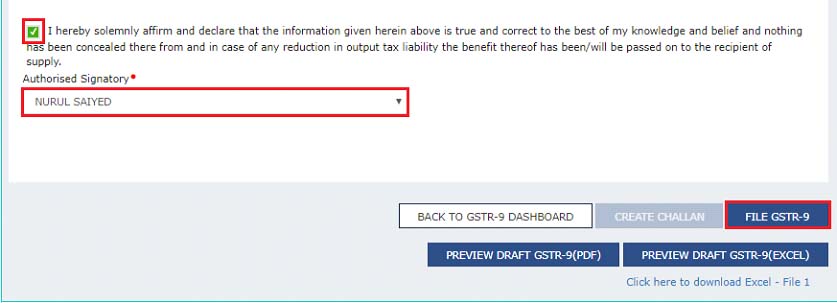

Step-14:

1.Select the Authorised signatory

2. Click on file GSTR-9

3. It will display with two options sign with EVC and DSC

4. EVC- An OTP will send to registered email id on Mobile number

5. DSC is required in the certificate and submits.

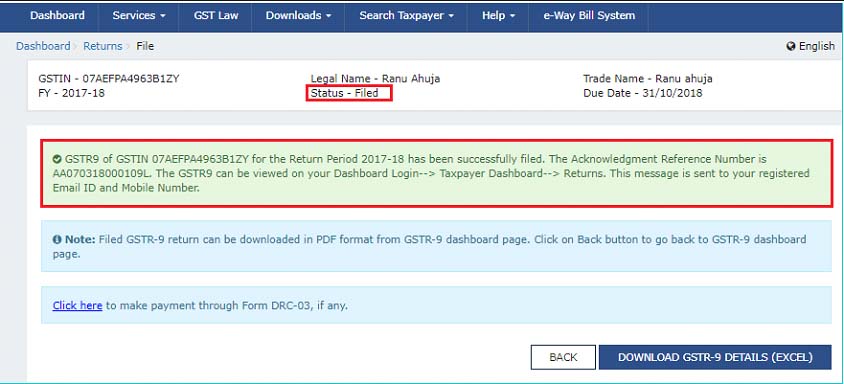

Step-15: And, click on proceed, the status filed.

Issues faced during filing of GST Annual Return, GSTR 9

Reconciliation of GSTR 2A and 3B – A thorn in filing GSTR 9

GSTR 2A and 3B will mismatch unless proper filing of GSTR 1 has been done from the counterparty/seller side. Any incorrect or non-filing of the same will be a mountainous task to reconcile with 3B if that has not been done on a monthly basis. In short, do your monthly/quarterly reconciliation of GSTR 2A and 3B and urge the counterparty to upload the same so as to avoid such mismatches.

Wrong Set off of Liability against ITC

In initial days of GST; Tax liability and ITC has to set off manually, which one might have wrongly set off due to improper knowledge on it. Hence, for the 1st year of GSTR 9, these might not match and show higher liability or lower ITC availed in CGST/SGST/IGST as the case may be, in few instances of business.

For example, CGST liability cannot set off with SGST credit and vice versa. During manual entry, the concerned party might have set off like mentioned above, which might have led to mismatch when filing an annual return.

How “The Account Masters” will help you in Online GST Annual Return?

The Account Masters will always touch with you for GST Annual Return. Our fees will be starting from Rs.1,999/- onwards.